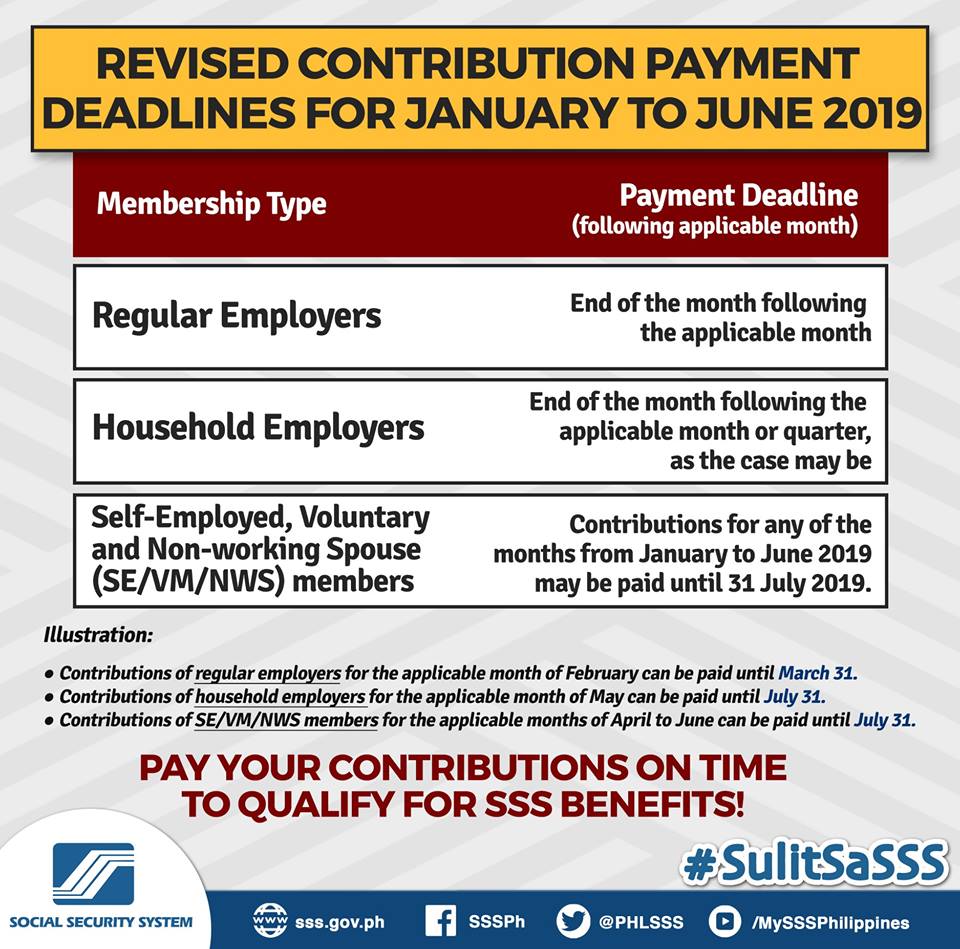

Social Security System members for employers must now adjust their calendar and mark the revised deadlines for the payment of their contributions.

Employers, self-employed, voluntary members, and non-working spouse members who opt to be SSS members must take note of the revised consolidated contribution schedule which will be applicable from the month of January up to June 2019.

The regular employers must remit the employees’ contribution every end of the month following the said applicable month. On the other hand, household employers have the option of paying every end of the month or quarterly.

This means that the contributions of the regular employers for the month of February can be paid until March 31. The household employer’s contribution for February can be paid until July 30.

Related: Consequences for not remitting workers SSS contribution

As for the voluntary members and the self-employed, the contributions from January 2019 to June 2019 can be paid until July 31, 2019.

The frequency of the contribution is still required to be on a monthly basis for regular employers while the household employers can choose monthly, quarterly, and semi-annually. If the deadline falls on a weekend or public holiday, the contribution must be paid on the next regular working day.

The revised deadlines are only applicable from January to June 2019.